Participating Members

31 OCTOBER 2025

WORLD SAVINGS DAY

Mr. Adrian Li - Co-Chief Executive The Bank of East Asia

Ms. Alexa Foglia - Banco Atlatida SME VP

Mr. Jay Khairil, Chief Executive Officer (CEO) Simpanan Nasional (BSN)

Ms. Françoise Toma - CEO of Spuerkeess

Mr. Antonio Romero General Manager- CECA

Ms. Aichurek Zhakypova - Deputy Chairwoman of the Board - Eldik Bank

Ms. Cynthia Ikponmwosa - Managing Director/CEO-Lapo Microfinance Bank

Mr. Gerhard Brandstätter - Chairman of the Sparkasse Bolzano

Mr. Jorge Guillermo Solís Espinoza - Chairman of the Board

Caja Huancayo

Mr. Kenneth Farrugia - Chief Executive Officer - Bank of Valletta

Ms. Rachel Mwesigwa - Savings Manager at Finca Uganda

Ms. Rebeca Romero Rainey - President and CEO - Independ Community Bankers of America(ICBA)

Mr. Toch Chaochek - CEO, Cambodia Post Bank Plc.

Ms. Victoria Nogueroles - Director of the Banco Nacional de Crédito

As part of World Savings Day, Banco Caja Social invites people to reflect on their financial habits. This savings campaign stems from a simple truth: spending is part of everyday life. Therefore, rather than saying “don't spend,” it seeks to raise awareness and alert people to consumption habits that can affect their financial health. With this campaign, the Colombian people's friendly bank reaffirms its commitment to promoting a culture of conscious saving and calls on people to access its savings products as a practical and safe way to build well-being and progress.

Banco Caja Social celebrates World Savings Day with its campaign “The legal side of saving”

For almost 115 years, Banco Caja Social has promoted saving as a driver of progress and well-being for millions of Colombians. As part of World Savings Day, which on October 31 celebrates 101 years since its creation by the World Savings Banks Institute (WSBI), the Bank is launching a new campaign that seeks to raise awareness about the importance of taking care of personal finances: “The legal side of saving.”

Halloween:Banco Caja Social launched a creative social media initiative inspired by Halloween. In a special video featuring local merchants, the most popular costumes of the year are highlighted, along with insights on how much Colombians spend during this season and simple tips to enjoy without overspending.

Good money management is the key to a successful future. We celebrate World Savings Day by promoting financial education.

Behind every goal, there’s an effort that’s worth it.

Because saving is not just setting money aside — it’s much more than that.

BNC joins the commemoration of World Savings Day by promoting money management education for younger generations. Saving starts today!

Incorporated in Hong Kong in 1918, The Bank of East Asia, Limited (BEA) is a leading Hong Kong-based financial services group that provides comprehensive wholesale banking, personal banking, wealth management, and investment services to its customers in Hong Kong, the Chinese Mainland, and other major markets around the world.

At BEA, our commitment to helping people enhance their financial wellbeing goes beyond banking—we empower individuals and communities with the knowledge and tools to manage money effectively and create meaningful impact—ultimately making a positive difference in the world.

Educating Primary Students on Financial Knowledge through Games

At the Financial Literacy Carnival co-organised by BEA and St. James’ Settlement last December, Hong Kong primary school students gained financial knowledge through interactive workshops and game challenges featuring the local cartoon character McDull and Friends. Activities during the three-day event centred on four money management topics, helping 500+ participants differentiate between needs and wants, create a budget, learn about digital payments, and protect themselves against fraud in a fun and engaging way.

|  |

|---|---|

|  |

Protecting Our Customers from Scams

As scams become more frequent and sophisticated, staying one step ahead is the best defence. To empower our customers with the knowledge they need to protect their finances and manage their daily banking needs online with boosted confidence, we hosted a Bank Smart Seminar in July at one of our branches in Hong Kong. Our Personal Banking team shared with the participants simple steps to fortify digital transactions, along with practical tips to safeguard their deposits and savings, with real-life examples.

Cultivating the NEXT Generation of Financial Talent

Earlier this year, our Group’s wholly-owned subsidiary, The Bank of East Asia (China) Limited, held the NEXT Financial Literacy Competition with several partners from the financial and education fields. The competition in Shanghai was designed to empower youths with financial knowledge and unleash their potential as future leaders in finance. Students competed in public speaking and shared their insights on the development of international financial centres. Winners recently completed a study tour in Hong Kong and London, gaining exposure and broadening their global perspectives.

The President of the Kyrgyz Republic recognized Eldik Bank as the successor to Kyrgyzstan's savings culture.

According to Decree No. 302 of the President of the Kyrgyz Republic, Sadyr Japarov, dated October 30, 2025, Eldik Bank OJSC is officially recognized as the successor to the savings culture in Kyrgyzstan, which began in 1925.

The document enshrines Eldik Bank's special role in preserving and developing the traditions of thrift and trust formed over 100 years of savings history in the country. The main goal of the decision is to preserve the historical legacy and strengthen the culture of financial responsibility among the citizens of Kyrgyzstan.

Historical Heritage

The first Soviet savings banks in Kyrgyzstan appeared in 1925 in the city of Osh and the Jangi-Jol district. They marked the beginning of a rich, century-long history of savings in the country: here, one could not only store money but also make money transfers, issue loan certificates, and conduct transactions with interest-bearing and securities. In Bishkek (then Frunze), one of the first savings banks was located at the intersection of Sovetskaya and Frunze Streets. The building still stands, and a sign on the façade advertises the opportunity to deposit money.

During the Great Patriotic War, savings banks actively supported the Soviet Army, holding public lotteries to support the front.

In the post-war years, they became a symbol of citizens' trust in the state. People not only saved but also participated in the then-popular "deposit draws."

In 1963, savings banks were transferred to the State Bank of the USSR as a separate institution. They became an integral part of the lives of Kyrgyz citizens. They were trusted implicitly, and it was known that they could do more than just save money. During this period, savings banks provided a fairly wide range of services. In 1987, an important transformation took place: savings banks in the republic became the Kyrgyz Republican Bank of the USSR Savings Bank. It was no longer just a collection of cash desks, but a powerful financial institution familiar to every resident of the country.

Transformation Stages

1987 – Transformation into the Kyrgyz Republican Bank of the USSR Savings Bank;

1991 – Transformation into the Commercial "Kyrgyzbank";

1996 – Liquidation of "Kyrgyzbank";

1996 – Establishment of JSC "Settlement and Savings Company";

1997 – JSC "Settlement and Savings Company" was recognized as the agent of the Government of the Kyrgyz Republic for the restoration of citizens' savings deposited in "Kyrgyzbank";

- 2008 – OJSC "Settlement and Savings Company" was renamed OJSC "RSK Bank"; - 2024 – RSK Bank OJSC was renamed Eldik Bank OJSC.

Eldik Bank proudly continues the century-old tradition of savings in Kyrgyzstan, carefully preserving the experience of generations and the invaluable legacy of trust that leads us into the future.

"Recognizing Eldik Bank as the successor to the savings culture is not only a great honor but also a tremendous responsibility to the country and its people. We are the heirs to a century-long history of trust and thrift, and it is important for us not only to preserve this legacy but to enhance it through innovation, sustainable development, and support for our clients. In accordance with the Presidential Decree, Eldik Bank is implementing a large-scale program of events dedicated to the 100th anniversary of savings in Kyrgyzstan, including initiatives to improve financial literacy, develop a savings culture, and strengthen trust in the national banking system," emphasized Ulanbek Nogaev, Chairman of the Management Board of Eldik Bank.

The Caisse d'Epargne 2025 study, “Cooperatives, a model for the future,”

In 2025, proclaimed International Year of Cooperatives by the UN, the Fédération nationale des Caisses d’Epargne devoted its third annual prospective study to the cooperative model. The study reveals that this model is not well known, but in line with the needs of the French people.

The Caisse d'Epargne 2025 study “Cooperatives, a model for the future,” takes the cooperative pulse of the french people, measures their perception of, and support for, this model, and assesses its capacity to develop in the future while meeting the aspirations and needs of the society.

The 2025 study was conducted by the Audirep institute, using a representative sample of 5,159 french people over the age of 18.

Regards sur l’Épargne publications

Since 2019, the Fédération nationale des Caisses d’Epargne has been publishing “Regards sur l’Épargne”, the Caisses d’Epargne newsletter on major topics related to savings, to provide objective and educational information to a wide audience based on expert testimony.

L’observatoire des jeunes et l’argent »(Finances & Pédagogie)

Money matters, handling correctly is learned, and it must be done early!

Finances & Pédagogie aims to adapt its educational content as much as possible to the needs of each generation. That is why the association sponsored by the Caisses d’Epargne has just launched “L’observatoire des jeunes et l’argent”. Through a series of qualitative groups, this study attempts to specify the new expectations and motivations of young people regarding financial issues. The first lesson learned from the 2025 edition is that young french people want to save money but are aware that they don't quite master how to do it. In the coming months, Finances & Pédagogie will develop content for young people on possible investments, with a focus on the risks related to crypto currencies, among other topics.

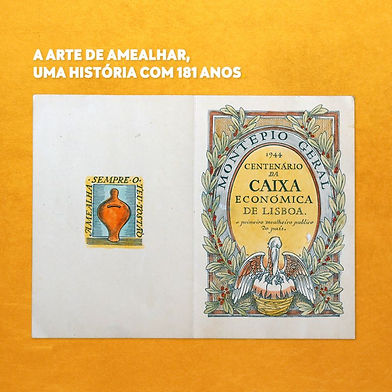

The ‘First Public Piggy Bank in the Country’:

-

The piggy banks of the Portuguese people.

-

The faithful keeper of dreams, happiness, future, and prosperity.

-

In this month dedicated to savings, we celebrate the history of a symbol that has spanned entire generations - the Banco Montepio Piggy Bank

This was the passbook distributed to minors who opened deposits during the week of the centenary celebrations of Caixa Económica de Lisboa (March 24 to 31, 1944).

Design by Professor Martins Barata.

Banco Montepio, values that grow with you.

Savings as a Catalyst for Climate Resilience and Financial Inclusion

On October 31st, two global movements converged to spotlight the transformative power of savings: the World Savings Day 2025, led by the World Savings and Retail Banking Institute (WSBI), and the Sustainable Finance Conference 2.0, held in Lagos, Nigeria. Though distinct in format and geography, both events shared a common ambition—to redefine savings not as a passive financial habit, but as an active tool for empowerment, resilience, and inclusive growth.

WSBI’s campaign, themed “This Is Not a Savings Account,” challenged conventional perceptions of saving. It framed savings as a vehicle for achieving life goals, from education and entrepreneurship to climate adaptation and long-term security. The message was clear: savings are not just about money—they are about agency, dignity, and future-building.

In Lagos, the Sustainable Finance Conference 2.0 brought together financial institutions, policymakers, and innovators to explore how microfinance can support climate-resilient communities. With a focus on digital innovation and grassroots engagement, the conference emphasized the role of inclusive finance in helping vulnerable populations adapt to environmental and economic shocks.

The intersection of these two initiatives underscored a broader truth: financial inclusion and climate resilience are deeply intertwined. Savings, when accessible and purpose-driven, can help individuals and communities withstand crises, invest in sustainable livelihoods, and participate more fully in the formal economy.

As the world grapples with the dual challenges of inequality and climate change, the events of October 31st offered a hopeful narrative. They called on financial institutions to innovate, on governments to support enabling policies, and on citizens to see savings not as a sacrifice, but as a strategy for survival and success.